1.2 Singapore at a glance

Geography

The Republic of Singapore sits 137 kilometres north of the equator, separated from Malaysia by the Strait of Johor and from Indonesia by the Strait of Singapore. It is made up of a main island, which is 42 kilometres long by 23 kilometres wide, and 63 islets. Singapore has a total area of just 716 square kilometres.

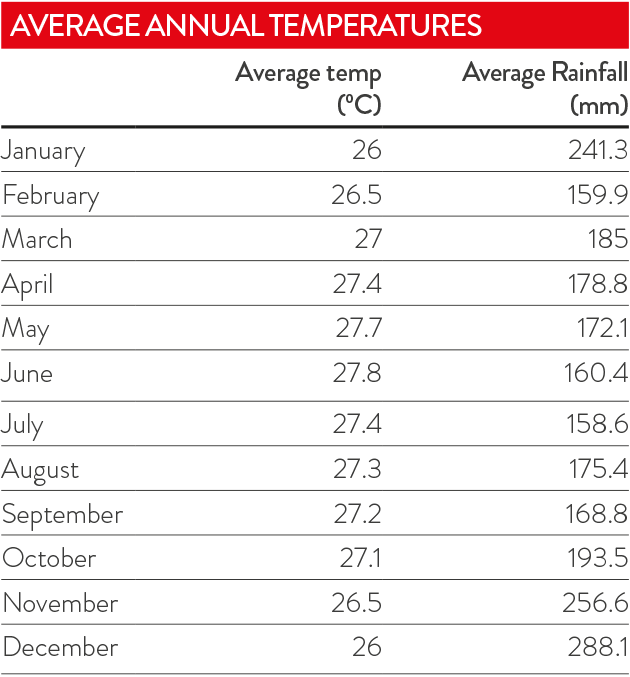

Singapore's climate is warm and humid, with an average daytime temperature of 31ºC and a minimum overnight average of 23ºC. The country receives an average of 1.9 metres of rain a year, and has two annual monsoon seasons – from December to early March, and from June to September.

History

Strategically located at the tip of the Malay Peninsula, Singapore has flourished as a trading post for centuries, with the earliest records of a permanent settlement dating from 1298 AD. Sir Stamford Raffles established the island as a British trading post in 1819, and by 1867 the city formed part of the Straits Settlements (along with Penang and Malacca) to become a British Crown Colony. It was occupied by the Japanese army in World War II, returned to British control after the war, then transitioned to a fully self-governed state in 1958.

The country held its first democratic elections in May 1959, won by the People's Action Party (PAP). Its leader, a young Cambridge-educated lawyer named Lee Kuan Yew, became Singapore's first Prime Minister. A merger with Malaysia in 1963 lasted just two years, and in 1965 Lee announced Singapore was to be a sovereign, democratic and independent nation – officially named the Republic of Singapore.

The modern story of Singapore, from 1965 onwards, is characterised by an ambitious economic policy. Singapore would soon be cited as an economic miracle, transforming itself from a developing country into a developed one in a matter of decades.

Culture

Singapore's population is around 5.5 million, of whom 3.8 million are citizens or permanent residents. Four main ethnic groups are represented: Chinese (who make up 74 per cent of the population), Malay (13 per cent), Indians (9 per cent) and Eurasians (1 per cent). Most locals identify as Singaporean when first asked, before outlining their ancestral heritage.

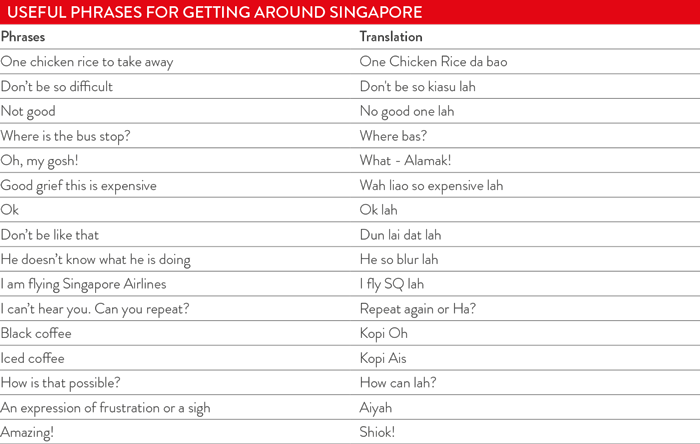

Singapore has four official languages: English, Malay, Chinese (Mandarin) and Tamil. English is the official language of government and commerce, and is spoken widely across the island. It is also the language of instruction in schools and universities. The other official language is Malay.

Singapore is a truly diverse melting pot of cultures and races, all of which contribute to the city's unique character. The naturally cosmopolitan society is based on an ideology of racial and religious harmony. Race quotas exist across a range of publicly administered sectors, including housing, schools and universities.

Singaporeans tend to be very open and direct, and are generally comfortable working with foreigners. Open displays of aggression or rudeness are rare, but they are not shy about saying no. Explanations and more information are not always readily offered, so it is worth asking more questions should you require further direction or advice. Great emphasis is placed on Asian values including filial piety, respect for elders and focus on the family and community.

Religion is an important part of everyday life for multicultural Singapore. Buddhists account for 34 per cent of the population, followed by Christians (18 per cent), Muslims (14 per cent) and Hindus (5 per cent).

Politics and government

Singapore functions as a parliamentary system of government and has an elected President as head of state, who serves a six-year term. The position is largely ceremonial as it is the Prime Minister who governs the country. Lee Hsien Loong, the son of Lee Kuan Yew, is the incumbent. On the advice of the Prime Minister, the President appoints other ministers from among the Members of Parliament to form the Cabinet. The Prime Minister and Cabinet are answerable to the Parliament. The Singapore Parliament has a single house, whose members are elected by general election every five years.

Economy

Singapore is a highly developed trade-oriented market economy. It has a strong and sophisticated economic structure and is the major regional hub for multinational businesses operating in Asia. The government has long pursued an outward-looking, export-oriented economic policy that encourages trade and investment. This has enabled Singapore to become a global hub with a trading capacity almost three times its GDP.

Singapore has enjoyed strong growth since independence, nudging an average 8 per cent over three decades. It was hit by the global financial crisis in 2008, falling into recession the following year then rebounding. Growth has levelled out at 2.5 per cent in 2012, 3.8 per cent in 2013, and 2.9 per cent in 2014.

With no natural resources to draw on, Singapore is overwhelmingly reliant on its human resources and has a workforce of 3.6 million, who enjoy the world's third-highest wages per capita. The services industry is by far the largest, accounting for up 70 per cent of the workforce, with manufacturing and construction both prominent employers.

The country's major industries include electronics, financial services, oil drilling equipment, petroleum refining, pharmaceutical manufacturing, advanced manufacturing, processed food and beverages, rubber products and ship repair. In recent years, the Government has moved to develop Singapore's services sector, as well as its biotechnology, chemical and petrochemical industries. This realignment has seen Singapore become simultaneously an important financial, trade and wealth management hub for Southeast Asia and a global focus of currency and commodity trading, transhipment and oil and gas refining.

Singapore's economy does carry challenges. As a result of its openness and reliance on trade and investment, it is vulnerable to global economic shocks and was the first Asian nation to enter recession after the 2008 global crisis.

Additionally, Singapore represents a small, crowded, competitive domestic market. A tight labour market means the cost of day-to-day operations can be high; retaining skilled labour and finding reasonably priced office space to rent can be difficult.

Infrastructure

Singapore's infrastructure ranks among the best in the world, with major transport links connected to all main points within the region. Getting around Singapore is made easy by its Mass Rapid Transport (MRT) system and comprehensive bus network. Malaysia can be accessed by car and bus through the Johor-Singapore causeway and the Tuas Second link: Kuala Lumpur is a four-hour drive.

The Global Competitiveness report of the World Economic Forum (2015-16) ranked Singapore second out of 144 countries for infrastructure (with Hong Kong first and Australia 16th). Singapore came third for quality of roads, second for ports and first for air transport.

Fixed-line telephones, mobile phones and the internet are readily available, and all Singaporean households have access to electricity. The World Economic Forum's Global Information Technology Report (2015) placed Singapore first in the world for networked readiness, which assesses the factors that enable a country to fully leverage information and communication technologies for increased competitiveness and wellbeing.

For more information, access the full Singapore Country Starter Pack